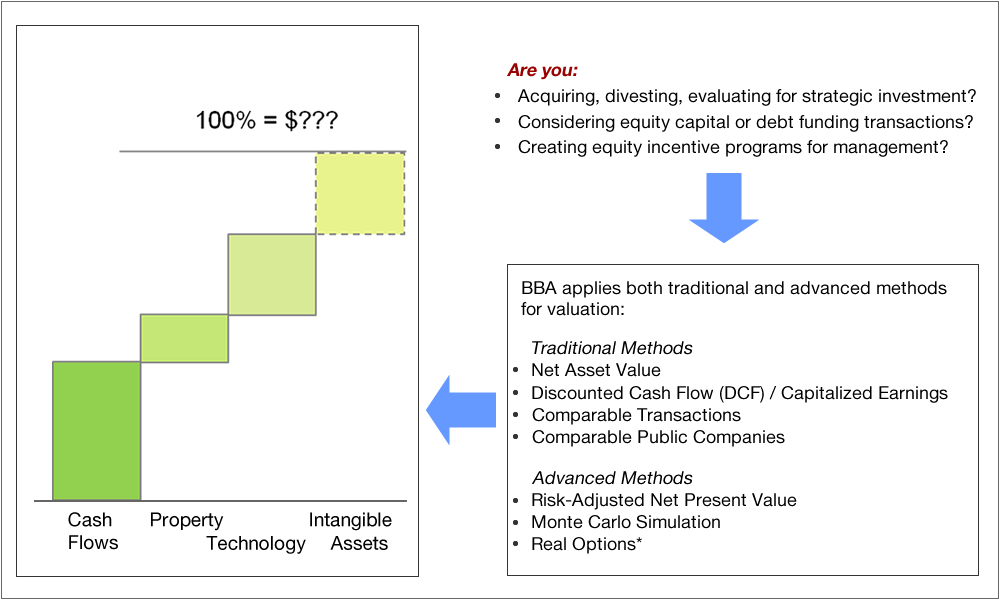

VALUATION SERVICES —

How Much is a Company Worth?

Traditional Methods

Net Asset Value - Estimates value as the sum of the company’s assets (including intangible assets) less its liabilities. This method is most appropriate for investment in holding companies but may also be used for operating companies that are marginally profitable, when a significant portion of a company’s assets are composed of liquid assets or other investments, or when a liquidation of the company is possible or expected.

Discounted Cash Flow / Capitalized Earnings - The discounted future cash flow method involves projecting estimated future income streams and discounting those income streams by an appropriate discount rate to arrive at today’s value. Earnings are forecasted for a number of future periods until such earnings reach a stable level of growth. Once the stable growth is achieved, a residual (or terminal) value is determined. This residual value is the value of all expected future income streams. The appropriate discount rate is the rate of return an investor would expect to earn based on the risks of investing in a given entity. The sum of present values for the projected income streams and the residual value results in a value estimate for the entity itself. The capitalized earnings method is a simplified approach where the stable growth phase starts immediately and only a residual value is calculated.

Comparable Transactions - Estimates value by comparing the company being valued to private and public companies that have been bought and sold. Information about the transaction values then is used to develop a valuation multiple (or multiples) that can then be applied to the target company to develop a value. Information on such transactions is available from several transaction databases. However, when evaluating past transaction it is important to consider that prices paid may be based on “synergies” expected by specific buyers and this may not be applicable to the company being valued.

Comparable Public Companies - The publicly traded guideline company method estimates value by comparing the company being valued to publicly traded companies that have their shares bought and sold on a stock exchange or over-the-counter. After calculating a Total Enterprise Value for the respective public companies multiples of revenues, earnings and other metrics can be calculated and then applied to the target company. However, comparability between public and private companies is often limited due to differences in size and other factors.

Advanced Methods

Risk-Adjusted Net Present Value - Projected future cash flows from a discounted cash flow analysis are adjusted by multiplying them with the estimated cumulative probabilities of success, providing “expected cash flows”. These expected cash flows are then discounted to a present value, but generally using a lower discount rate than in a traditional discounted cash flow analysis since at least a portion of the project or company specific risk has been removed. Frequently used by pharmaceutical companies for financial evaluation of drugs under development. A significant improvement over a traditional discounted cash flow analysis, but the result is an average outcome which may not fully reflect risks.

Monte Carlo Simulation - Uses a large number of simulation trials (scenarios) based on random numbers as “seed” to arrive at a distribution of outcomes rather than a single result, often in the form of a modified discounted cash flow analysis. Critical input assumptions can be provided in the form of probabilities or distributions (e.g. expected High/Median/Low outcomes for a variable). Particularly helpful when there is high uncertainty regarding input assumptions such as for early stage biotechnology companies or other tech development. Results may be more challenging to understand compared with other methods however.

Real Options - Evaluation of an investment decision or similar situation outside of the financial markets using a Black-Scholes, binomial lattice or other options model. A project may have a negative expected net payoff from a discounted cash flow analysis, but when given “optionality” value, the project may still makes sense to pursue. Can be used to evaluate patents, which could be considered options on developing and commercializing innovations. However this method can be cumbersome to implem product development process involves many steps.